1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

150

151

152

153

154

155

156

157

158

159

160

161

162

163

164

165

166

167

168

169

170

171

172

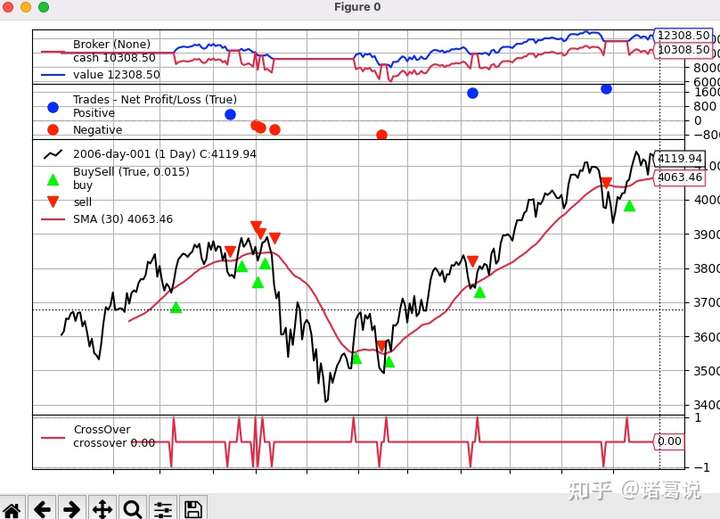

| import argparse

import datetime

# 导入backtrader相关包

import backtrader as bt

import backtrader.feeds as btfeeds

import backtrader.indicators as btind

# 交易策略

class SMACrossOver(bt.Strategy):

params = (

('stake', 1), # 交易股数

('period', 30), # 周期长度

)

def log(self, txt, dt=None):

''' Logging function fot this strategy'''

dt = dt or self.datas[0].datetime.date(0)

print('%s, %s' % (dt.isoformat(), txt))

# 打印订单信息,可选

def notify_order(self, order):

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

return

# Check if an order has been completed

# Attention: broker could reject order if not enougth cash

if order.status in [order.Completed, order.Canceled, order.Margin]:

if order.isbuy():

self.log(

'BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

else: # Sell

self.log('SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

# 打印交易信息,可选

def notify_trade(self, trade):

if trade.isclosed:

self.log('TRADE PROFIT, GROSS %.2f, NET %.2f' %

(trade.pnl, trade.pnlcomm))

# 初始化策略属性、指标,必须

def __init__(self):

sma = btind.SMA(self.data, period=self.p.period)

# > 0 crossing up / < 0 crossing down

self.buysell_sig = btind.CrossOver(self.data, sma)

# 交易逻辑实现,必须

def next(self):

if self.buysell_sig > 0:

self.log('BUY CREATE, %.2f' % self.data.close[0])

self.buy(size=self.p.stake) # keep order ref to avoid 2nd orders

elif self.position and self.buysell_sig < 0:

self.log('SELL CREATE, %.2f' % self.data.close[0])

self.sell(size=self.p.stake)

def runstrategy():

args = parse_args()

# 实例化cerebro

cerebro = bt.Cerebro()

# Get the dates from the args

fromdate = datetime.datetime.strptime(args.fromdate, '%Y-%m-%d')

todate = datetime.datetime.strptime(args.todate, '%Y-%m-%d')

# 从csv文件读取数据

data = btfeeds.BacktraderCSVData(

dataname=args.data,

fromdate=fromdate,

todate=todate)

# 将数据传给cerebro

cerebro.adddata(data)

# 添加策略

cerebro.addstrategy(SMACrossOver, period=args.period, stake=args.stake)

# 设置初始资金

cerebro.broker.setcash(args.cash)

commtypes = dict(

none=None,

perc=bt.CommInfoBase.COMM_PERC,

fixed=bt.CommInfoBase.COMM_FIXED)

# 设置交易佣金

cerebro.broker.setcommission(commission=args.comm,

mult=args.mult,

margin=args.margin,

percabs=not args.percrel,

commtype=commtypes[args.commtype],

stocklike=args.stocklike)

# 启动回测

cerebro.run()

# 绘图

if args.plot:

cerebro.plot(numfigs=args.numfigs, volume=False)

# 从命令行解析参数

def parse_args():

parser = argparse.ArgumentParser(

description='Commission schemes',

formatter_class=argparse.ArgumentDefaultsHelpFormatter,)

parser.add_argument('--data', '-d',

default='../../datas/2006-day-001.txt',

help='data to add to the system')

parser.add_argument('--fromdate', '-f',

default='2006-01-01',

help='Starting date in YYYY-MM-DD format')

parser.add_argument('--todate', '-t',

default='2006-12-31',

help='Starting date in YYYY-MM-DD format')

parser.add_argument('--stake', default=1, type=int,

help='Stake to apply in each operation')

parser.add_argument('--period', default=30, type=int,

help='Period to apply to the Simple Moving Average')

parser.add_argument('--cash', default=10000.0, type=float,

help='Starting Cash')

parser.add_argument('--comm', default=2.0, type=float,

help=('Commission factor for operation, either a'

'percentage or a per stake unit absolute value'))

parser.add_argument('--mult', default=10, type=int,

help='Multiplier for operations calculation')

parser.add_argument('--margin', default=2000.0, type=float,

help='Margin for futures-like operations')

parser.add_argument('--commtype', required=False, default='none',

choices=['none', 'perc', 'fixed'],

help=('Commission - choose none for the old'

' CommissionInfo behavior'))

parser.add_argument('--stocklike', required=False, action='store_true',

help=('If the operation is for stock-like assets or'

'future-like assets'))

parser.add_argument('--percrel', required=False, action='store_true',

help=('If perc is expressed in relative xx% rather'

'than absolute value 0.xx'))

# -p或--plot 需要画图

parser.add_argument('--plot', '-p', action='store_true',

help='Plot the read data')

parser.add_argument('--numfigs', '-n', default=1,

help='Plot using numfigs figures')

return parser.parse_args()

# 主函数

if __name__ == '__main__':

runstrategy()

|